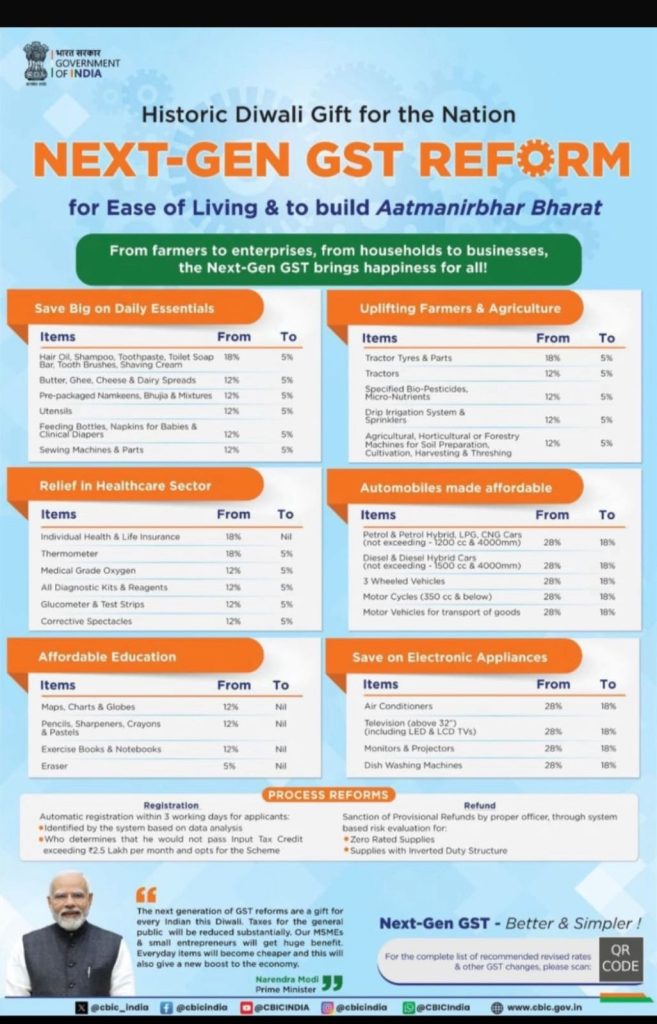

ZERO GST ON 33 LIFE SAVING DRUGS, Ultra-High Temperature (UHT) milk, Chena or paneer, pre-packaged and labelled, Pizza bread, Khakhra, Chapathi or Roti, Maps, Charts, Globes, Pencils, Sharpeners, Crayons, Pastels, Exercise Books, Notebooks, Erasers

GST exemption on Individual Health and life Insurance Policies

5 percent tax rate on personal care items such as hair oil, shampoo, toothpaste, and dental floss, ELECTRIC CARS

Increased the tax on cigars, cheroots, cigarillos, cigarettes, and other tobacco products, including substitutes

slashed the tax rate on popular items like namkeens, bhujia, mixtures, chabena and other ready-to-eat packaged snacks

GST reforms would strengthen key economic sectors, stimulate economic activity, and enable sectoral expansion, PM Modi said.

New Delhi, Sep 03 In a landmark move, the GST Council, chaired by Finance Minister Nirmala Sitharaman, on Wednesday rationalised the indirect tax structure, cutting the current four slabs down to two — scrapping the 12 per cent and 28 per cent rates, while retaining the 5 per cent and 18 per cent slabs.

The changes in GST rates on services will be implemented from September 22.

The GST Council has reduced the tax rate on personal care items such as hair oil, shampoo, toothpaste, and dental floss from 18 per cent to 5 per cent.

From groceries and fertilisers to footwear, textiles, and even renewable energy, a broad basket of goods and services is set to become more affordable. Items earlier taxed at 12 per cent and 28 per cent will now largely migrate to the other two slabs, making a wide range of products cheaper.

Food and daily essentials

Milk products: Ultra-high temperature (UHT) milk will now be tax-free (down from 5 per cent), while condensed milk, butter, ghee, paneer, and cheese have moved from 12 per cent to 5 per cent or nil in some cases.

Staple foods: Malt, starches, pasta, cornflakes, biscuits, and even chocolates and cocoa products will see rates reduced from 12–18 per cent to 5 per cent.

Dry fruits and nuts: Almonds, pistachios, hazelnuts, cashews, and dates, earlier taxed at 12 per cent, will now attract just 5 per cent.

Sugar and confectionery: Refined sugar, sugar syrups, and confectionery items like toffees and candy have shifted to the 5 per cent slab.

Other packaged foods: Vegetable oils, animal fats, edible spreads, sausages, meat preparations, fish products, and malt extract-based packaged foods have been moved to the 5 per cent slab.

Namkeens, bhujia, mixture, chabena and similar edible preparations ready for consumption form (other than roasted gram), pre-packaged and labelled to go from 18 per cent to 5 per cent.

Waters, including natural or artificial mineral waters and aerated waters, not containing added sugar or other sweetening matter, nor flavoured to move from 18 per cent to 5 per cent.

Agriculture and fertilisers

Fertilisers are down from 12 per cent/18 per cent to 5 per cent.

Select agricultural inputs, including seeds and crop nutrients, have been rationalised from 12 per cent to 5 per cent.

Healthcare

Life-saving drugs, health-related products, and some medical devices have seen rate cuts from 12 per cent/18 per cent to 5 per cent or nil.

Consumer goods

Entry-level and mass-use items like select electrical appliances will move from 28 per cent to 18 per cent.

Footwear and textiles have seen GST cut from 12 per cent to 5 per cent, reducing costs for mass-market products.

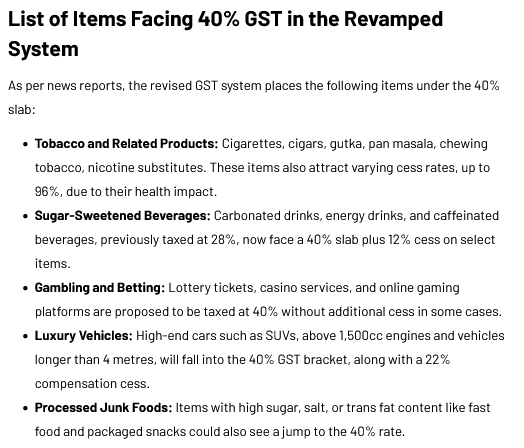

It has increased the tax on cigars, cheroots, cigarillos, cigarettes, and other tobacco products, including substitutes, from 28 per cent to 40 per cent.

Moreover, the GST Council has slashed the tax rate on popular items like namkeens, bhujia, mixtures, chabena and other ready-to-eat packaged snacks. These items, which earlier attracted 12 per cent GST, will now fall under the 5 per cent slab, making them more affordable for consumers.

Meanwhile, the Council has raised the tax rate on all goods containing added sugar, sweeteners, or flavours, including aerated waters, from 28 per cent to a steep 40 per cent.

Prime Minister Narendra Modi had stated in his Independence Day speech that the Central government is proposing significant reforms in GST, focused on 3 pillars of structural reforms, rate rationalisation, and ease of living.

The key areas identified for next-generation reforms include rationalisation of tax rates to benefit all sections of society, especially the common man, women, students, middle class, and farmers.

The reforms will also seek to reduce classification-related disputes, correct the inverted duty structures in specific sectors, ensure greater rate stability, and further enhance ease of doing business.

GST reforms would strengthen key economic sectors, stimulate economic activity, and enable sectoral expansion, PM Modi said.