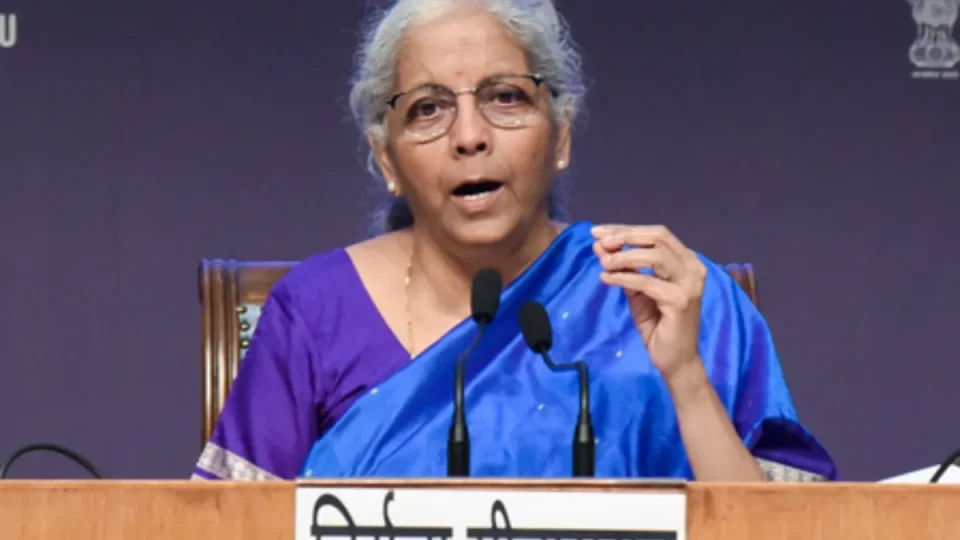

New Delhi, Sep 06 Finance Minister Nirmala Sitharaman stated that GST rate cuts, effective September 22nd, are anticipated to stimulate economic growth, thereby offsetting the adverse impact of a US tariff hike on Indian exports.

The government’s primary objective is to ensure these rate reductions benefit consumers, supported by a rigorous vigilance exercise involving industry stakeholders and Members of Parliament.

The revamped GST framework, a suggestion from Prime Minister Narendra Modi eight months ago, aims for simplification, particularly benefiting the middle class and businesses, including MSMEs and startups.

The new structure introduces a two-slab system (5% and 18%), eliminating previous 12% and 28% rates for most goods and services, while a 40% rate is maintained for luxury and “sin goods” to ensure fairness and revenue. Compliance costs are reduced through streamlined registration, return filing, and faster refunds.

On international trade, the Minister affirmed India’s continued purchase of Russian oil based on economic considerations, citing its significance as the costliest item in the import bill, irrespective of external pressures. The government also plans measures to support sectors affected by the US tariff increase.